stamp duty for tenancy agreement malaysia

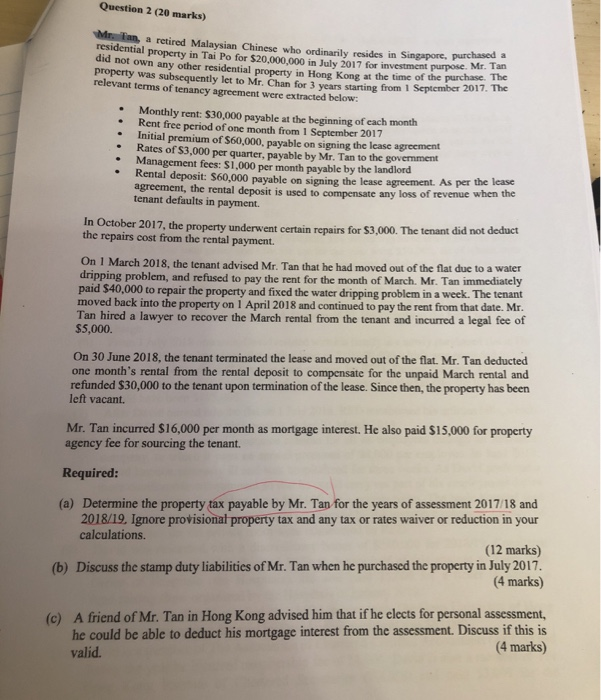

TNB shall inform the move-in customer once the COT process is successful. Make payment for Processing fee RM3 for LV RM80 for MVHV Stamp Duty RM10 and Security Deposit depends on the premise category.

Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

As of new laws brought into effect from 2019 tenancy agreements in the ACT may include a lease break fee which is required to be paid by the tenant to the landlord if they wish to end the agreement early.

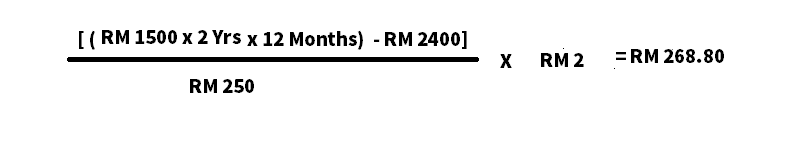

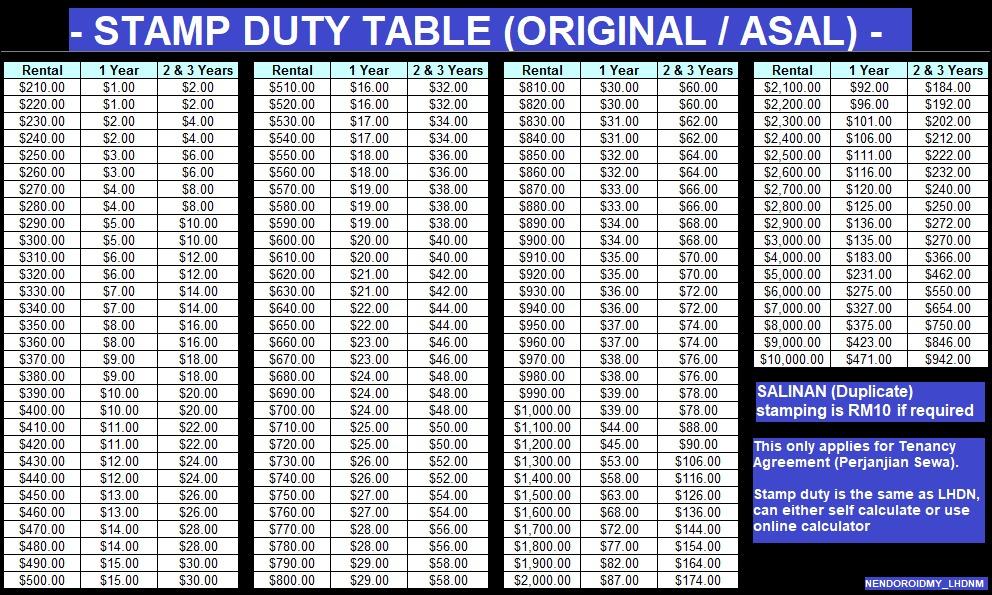

. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. As the tenancy agreement was made through a property application on your phone which would have generated andor stored an electronic record of the transaction an electronic document chargeable with stamp duty would be created. A sends an email from Malaysia offering to sell property to B.

The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. 1 Legal Calculator App in Malaysia. Pros and cons of periodic tenancy.

Contracts Act 1950 is the legislation which would cover conflicts on the tenancy agreement. The rules around the amount of notice required vary from state to state but landlords generally need to give more notice than the tenant. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

And so if the property is sold to an investor who a tenanted property its possible you will experience very few changes. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. According to the Registration Act 1908 the registration of a lease agreement is mandatory if.

Please return the softcopy a full set of agreement together with Resit Rasmi Setem to HRD Corp by link email provided. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Stamp duty on rental agreements.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. However Sanderson explained that it can also lead to a termination of the lease if mutual consent is reached. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250.

Iii However prior to the completion of a year Tempoh kontrak year period from the date hereof-. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Enter the monthly rental duration number of additional copies to be stamped.

A periodic tenancy is a month-to-month agreement that continues until either party gives notice. Once LHDN officer approved you need to print the Resit Rasmi Setem Stamp Official Receipt and attach it into original agreement as a proof that stamp duty payment has been made and scan all together in one file. Legal Fee - Sale Purchase Agreement Loan Agreement.

This has to be in writing and must specify when the agreement will end. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

The copyright to the. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. If you are on a fixed-term agreement but you want to move out because the property is being sold you may be able to end the tenancy.

Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. As such you would need to pay stamp duty on the lease of the property.

Stamp duty is the governments charge levied on different property transactions. How Much Is Stamp Duty For Tenancy Agreement In 20202021. Civil Law Act 1956 is the legislation which would cover payment disputes.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. If the rental provider finds new tenant within a set period defined in the agreement then this amount is reduced. B sends an email from Singapore accepting As offer.

And if the Tenancy Agreement has been signed for more than 3 years the. Specific Relief Act 1950 prohibits a landlord evicting the tenant or making the property inaccessible to tenants without a court order. Online calculator to calculate Tenancy Agreement Stamp Duty.

Distress Act 1951 is the legislation covering matters of eviction. Get 247 customer support help when you place a homework help service order with us. Any person guilty of such an offence shall be liable on conviction to a fine not exceeding 10000 or to imprisonment for a term not exceeding 3 years or to both.

So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs. Ii After completion of Tempoh kontrak year tenancy period from the date hereof if the Tenant desires to terminate the Tenancy Agreement before the expiration of the term hereby created the Tenant shall be required to give a three 3 month written notice of such sooner determination.

The agreement is not subject to stamp duty as the foreign company is not registered in Singapore and does not. This lets us find the most appropriate writer for any type of assignment. 500- whichever is lower.

A full stamp duty exemption is given on. Most rent agreements are signed for 11 months so that they can avoid stamp duty and other charges. The existing customer the move-out customer shall be contacted by TNB to confirm hisher agreement to close hisher electricity account.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Meanwhile if you wish to know more about the Real Property Gain Tax we recommend users to contact us or download EasyLaw mobile - The No. Also read all about income tax provisions for TDS on rent.

The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your. To use this calculator. Stamp duty is 1 of the total rent plus deposit paid annually or Rs.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Stamp Duty is a tax on dutiable documents relating to immovable properties in Singapore and stocks and shares. This website belongs to GTRZ.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Yes it is an offence under Section 62 of Stamp Duties Act to evade stamp duty by executing a document where facts and circumstances are not fully and truly set forth. The stamp duty is free if the annual rental is below RM2400. Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia.

How Much Is Stamp Duty For Tenancy Agreement Youtube Seremban Property Youtube

![]()

Tenancy Agreement In Malaysia Lo Partnerslo Partners

Stamp Duty Notes Pptx Bkat3033 A Specialised Taxation Group 10 Stamp Duty No Name 1 2 3 4 Aishah Binti Mat Isa Tay Yih Thern Hwong Boh Course Hero

Stamp Duty Calculation Malaysia Tenancy Agreement Rashadtrf

Stamping Of Tenancy Agreement Semionline Property Malaysia

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

Property Renting Tip 2 Stamping The Tenancy Agreement Propwise Sg Singapore Property Blog Investing In Singapore Real Estate Hdb Condos Houses

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Question 2 20 Marks Milan A Retired Malaysian Chegg Com

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Know Your Stuff Understanding The Basics Of Renting The Edge Markets

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Thanks Madam For The Support Facebook

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

How Important Of Stamping The Tenancy Agreement Dr Homesearch

Comments

Post a Comment